CPI Drops Below 2%: Fed Inflation Target Reached

Published 23 Jan, 2024

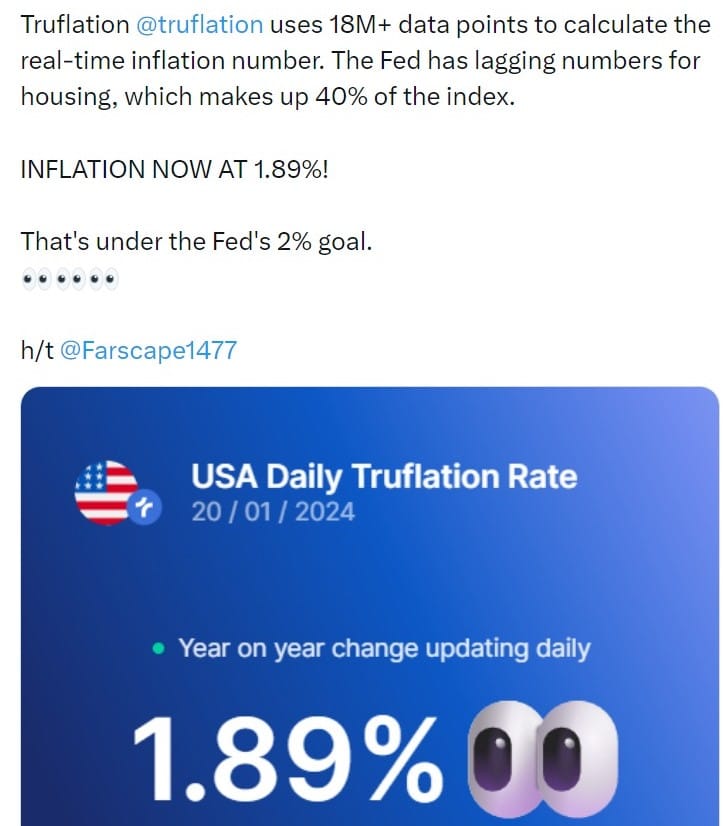

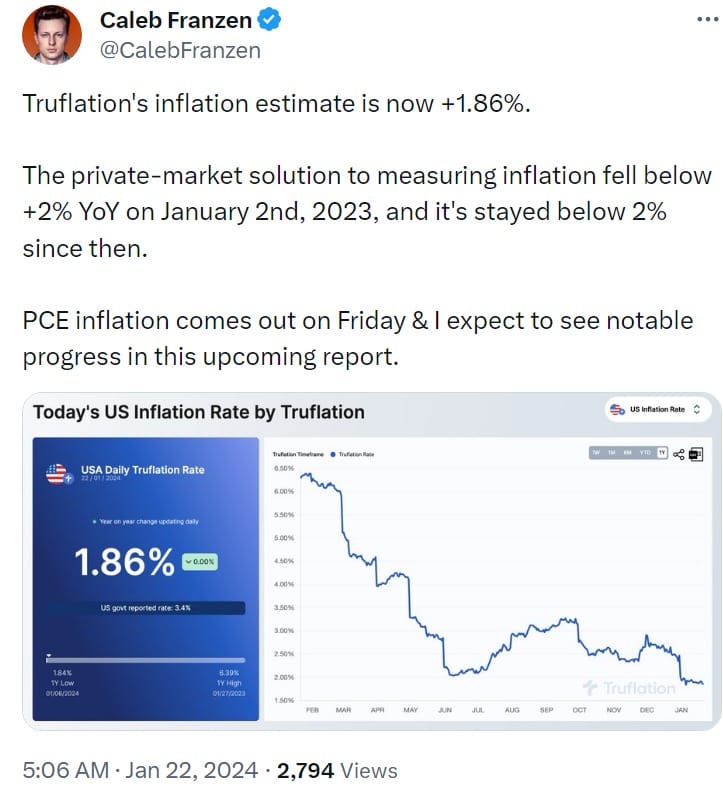

Veteran financial analyst From Growth To Value noticed, bigly.

Tipped by a follower, the post was indicative of what would soon follow across the financial world: a flood of online gasps.

That's Under the Fed's 2% Goal

Eyeball emojis littering the tweet, From Growth To Value posted, "Truflation uses 18M+ data points to calculate the real-time inflation number. The Fed has lagging numbers for housing, which makes up 40% of the index. INFLATION NOW AT 1.89%! That's under the Fed's 2% goal."

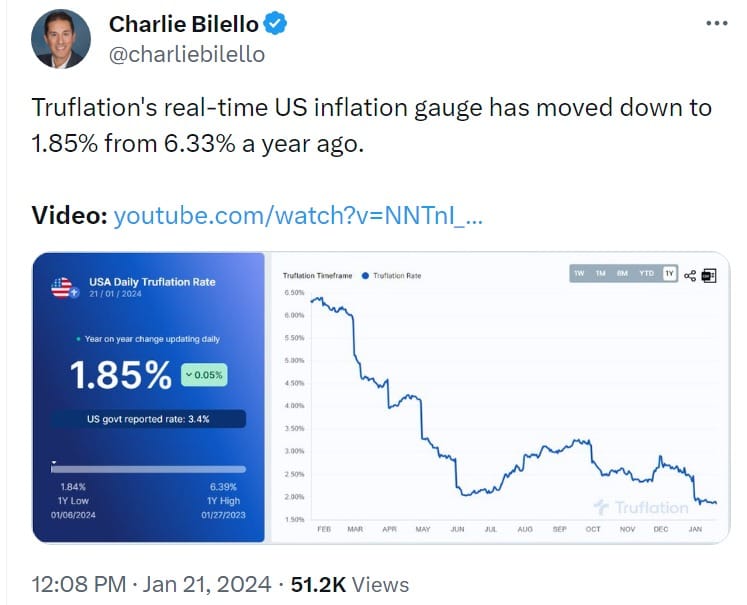

Over the weekend, Truflation.com indeed printed a sub-2% US CPI, landing at 1.89% on Saturday, 20 January 2024. By Sunday, it slipped four more points. As of publication, US CPI sits at jaw-dropping 1.82%.

What if the Fed Already Won the Inflation Fight?

Investor and popular podcast host, Anthony Pompliano, asked, "What if the Fed already won the inflation fight? @truflation, the leading alternative inflation measurement, is showing that the Federal Reserve has already successfully achieved their 2% inflation target."

The Federal Reserve's 2% inflation target is a key component of its monetary policy framework. This target represents the central bank's goal for the annual increase in the price level of goods and services. The Fed believes that a moderate and stable inflation rate of 2% supports the overall economic health and contributes to the achievement of its dual mandate of maximum employment and price stability.

Sticky, Higher Inflation? Doesn't Really Look Like It

Raoul Pal, co-founder and CEO of Real Vision, noted, "Sticky, higher inflation? Doesn't really look like it. My view remains that CPI will hit near zero this cycle, as will core CPI (delayed). PPI has been negative for a while now, too... the inflation undershoot excuse for MOAR (election) COWBELL waits in the wings..."

One primary reason the Fed targets a 2% inflation rate is to guard against deflationary pressures. Deflation, or a sustained decrease in the general price level of goods and services, can be detrimental to an economy. It may lead to reduced consumer spending as individuals postpone purchases in anticipation of lower prices in the future. This behavior can result in a downward economic spiral, with falling demand, reduced production, and increased unemployment. By aiming for a positive inflation rate, the Fed seeks to avoid these deflationary risks and maintain a stable economic environment.

Official Rationale Behind the Federal Reserve's 2% Inflation Target

The Federal Reserve's commitment to maintaining a 2% inflation target has been a cornerstone of its monetary policy strategy for decades. Its choice of a 2% inflation target is grounded in a multifaceted approach that prioritizes price stability, guards against deflation, maintains flexibility in monetary policy, facilitates adjustments in the labor market, and enhances communication.

Price Stability and Economic Growth

Central to the Federal Reserve's decision is the belief that a moderate and stable inflation rate promotes overall economic health. Research by Mishkin (1995) emphasizes the importance of price stability in fostering sustainable economic growth. By targeting a 2% inflation rate, the Fed aims to strike a balance that avoids the pitfalls of both deflation and excessively high inflation.

Guarding Against Deflation

Deflation, a sustained decrease in the general price level, poses significant risks to economic stability. As highlighted by Bernanke (2003), the 2% inflation target serves as a buffer against deflationary pressures. Maintaining a positive inflation rate provides the Federal Reserve with the necessary flexibility to address economic downturns effectively, preventing the negative consequences associated with deflation.

Nominal Interest Rate Buffer

Economists like Woodford (2003) argue that a 2% inflation target allows the Fed to maintain a nominal interest rate buffer. In a low-inflation or deflationary environment, central banks may struggle to implement effective monetary policy due to the limitations of traditional tools. The 2% target provides the Fed with room to maneuver interest rates, ensuring a more robust response to economic challenges.

Facilitating Adjustments in the Labor Market

The Federal Reserve recognizes the importance of a smoothly functioning labor market in achieving its dual mandate of maximum employment. A 2% inflation target, as discussed by Clarida et al. (2000), facilitates price and wage adjustments. This flexibility aids businesses in adapting to changing economic conditions, contributing to a more stable and adaptable labor market.

Communicating Policy Intentions

Transparency and communication are integral aspects of the Federal Reserve's approach to monetary policy. The 2% inflation target serves as a clear and understandable goal for the public, businesses, and financial markets. According to Evans (2003), explicit inflation targeting enhances the effectiveness of the central bank's communication, anchoring inflation expectations and promoting economic stability.

Reassessing the 2% Inflation Target

As economic landscapes evolve, it is essential to critically evaluate whether this target remains optimal.

Deflationary Risks

One significant concern with the 2% inflation target is the potential deflationary risks associated with such a policy. Economists such as Svensson (2003) argue that aiming for a positive inflation rate leaves little room to combat deflation effectively. In a world where technological advancements and increased productivity can lead to falling prices, a rigid inflation target may hinder the central bank's ability to navigate deflationary pressures.

Impact on Low-Income Individuals

Critics, including Ball and Mankiw (1994), contend that a 2% inflation target disproportionately affects low-income individuals. Inflation erodes the purchasing power of money, and those with limited financial resources may struggle to keep pace with rising prices. This regressive impact raises questions about the equity and social justice implications of maintaining a fixed inflation target.

Distorted Price Signals

Research by Woodford (2003) highlights concerns about the distorting effect of a 2% inflation target on price signals in the economy. Aiming for a specific inflation rate may lead to misallocation of resources, as firms adjust prices and wages to meet the target rather than responding to genuine market forces. This distortion can contribute to inefficiencies and hinder the smooth functioning of markets.

Limited Policy Space

Some economists, such as Blanchard et al. (2010), argue that a rigid inflation target limits the central bank's policy space during economic downturns. In situations where interest rates are already low, adhering to a 2% inflation target constrains the effectiveness of traditional monetary policy tools. This limitation raises concerns about the central bank's ability to respond adequately to economic crises.

Communication Challenges

While transparency is a key aspect of the Fed's communication strategy, critics like Orphanides (2003) suggest that the 2% inflation target may lead to communication challenges. A strict focus on the target may create confusion during periods of deviation from the goal, potentially undermining the effectiveness of forward guidance and jeopardizing the central bank's credibility.

In reevaluating the 2% inflation target, it is crucial to consider the potential drawbacks associated with this policy. Concerns about deflationary risks, the impact on low-income individuals, distorted price signals, limited policy space, and communication challenges highlight the need for a nuanced approach to inflation targeting. As the economic landscape evolves, policymakers should remain open to adjusting the inflation target to better align with the changing realities of the global economy.

Sources

Ball, L., & Mankiw, N. G. (1994). Asymmetric Price Adjustment and Economic Fluctuations. Economic Journal, 104(423), 247–261.

Bernanke, B. S. (2003). Making Sure "It" Doesn’t Happen Here. Speech at the National Economists Club, Washington, D.C.

Blanchard, O., Dell'Ariccia, G., & Mauro, P. (2010). Rethinking Macroeconomic Policy. Journal of Money, Credit and Banking, 42(s1), 199–215.

Clarida, R., Gali, J., & Gertler, M. (2000). Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory. Quarterly Journal of Economics, 115(1), 147–180.

Evans, C. L. (2003). Economic Uncertainty and the Effectiveness of Monetary Policy. Speech at the Distinguished Speaker Series, London.

Mishkin, F. S. (1995). Symposium on the Monetary Transmission Mechanism. Journal of Economic Perspectives, 9(4), 3–10.

Orphanides, A. (2003). The Quest for Prosperity without Inflation. Journal of Monetary Economics, 50(3), 633–663.

Svensson, L. E. (2003). What Is Wrong with Taylor Rules? Using Judgment in Monetary Policy through Targeting Rules. Journal of Economic Literature, 41(2), 426–477.

Woodford, M. (2003). Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton University Press.

Privacy Policy | © 2024. Truflation - All Rights Reserved.